Protecting your vehicle is key, and the right car insurance is crucial. A good insurance plan covers damages and injuries in accidents. With many options, finding the right policy can be tough.

In the UK, good car insurance is vital for unexpected events. A comprehensive plan covers your vehicle and any harm you might cause. Knowing your options helps you choose wisely.

Learning about car insurance types, like comprehensive plans, is important. The right coverage gives you peace of mind against unexpected events.

Key Takeaways

- Having the right car insurance coverage is essential to protect your vehicle and financial well-being.

- A comprehensive insurance plan can provide coverage for damages to your vehicle and any injuries or damages you may cause to others.

- Understanding the different types of car insurance coverage is crucial to make an informed decision about your auto insurance policy.

- In the United Kingdom, having a good car insurance coverage is crucial to ensure you are protected in case of any unexpected events.

- A comprehensive insurance plan can provide financial protection in case of an accident or other unforeseen events.

- It is essential to choose the right car insurance coverage to ensure you are protected and have peace of mind.

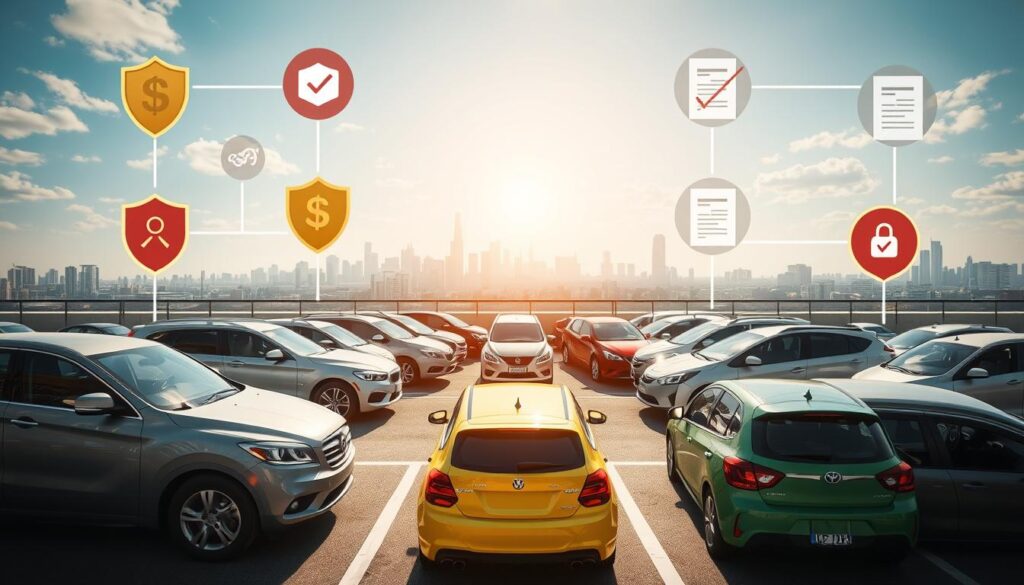

Understanding Different Types of Car Insurance Coverage

Choosing the right car insurance means knowing the different coverage types. It’s important to find quotes that fit your needs. Affordable coverage isn’t just about the lowest price. It’s about having enough protection for accidents or vehicle damage.

In the UK, you can choose from third-party, comprehensive, and gap insurance. Each has its own benefits and downsides. By comparing options and getting the best quotes, you can find a plan that’s both affordable and protective.

When picking car insurance, consider the coverage level, excess amount, and extra features. Reading reviews and checking the provider’s reputation is also key. This way, you can find reliable and affordable coverage that meets your needs.

Finding the right car insurance is about finding a balance between what you need and what you can afford. By understanding the different types and comparing options, you can make a smart choice. This ensures you have affordable coverage that protects you and gives you peace of mind.

| Type of Coverage | Description |

|---|---|

| Third-Party Coverage | Covers damages or injuries caused to others |

| Comprehensive Insurance | Covers damages to your vehicle, regardless of who is at fault |

| Gap Insurance | Covers the difference between the vehicle’s value and the outstanding loan amount |

Factors That Affect Your Car Insurance Coverage

Several factors can change your car insurance coverage and how much you pay. To compare insurance coverage well, knowing these factors is key. Your driving history is a big one. A clean record means lower costs, but accidents or tickets raise your rates.

Your age and where you live also matter. Some jobs or groups get discounts, affecting your costs. By looking at different options, you can find a good deal. Important things to think about include:

- Driving history and experience

- Age and location

- Vehicle type and value

- Profession or affiliation

Knowing how these factors influence your insurance helps you choose wisely. It’s also smart to check and update your policy often. This way, you get the right coverage and feel safe driving.

Conclusion: Making an Informed Decision About Your Vehicle Coverage

Finding the right car insurance is key to protect your vehicle and money. It’s important to know what car insurance covers and look at different options. This way, you can pick a plan that fits your needs and budget.

When looking at car insurance, think about the type of coverage, how much it costs, and what you have to pay out of pocket. Also, consider extra options like gap insurance. This helps ensure your vehicle is safe and you can drive without worry. Now, you have the knowledge to find the right coverage for your vehicle.

FAQ

What is third-party car insurance coverage?

Third-party coverage is a basic car insurance type. It protects you against damages or injuries you cause to others in an accident. It doesn’t cover your own vehicle.

What are the benefits of comprehensive car insurance?

Comprehensive insurance covers damages to your vehicle, no matter who’s at fault. It protects against theft, vandalism, and natural disasters.

What is gap insurance, and how can it provide additional protection?

Gap insurance pays the difference between what you owe on your car and its actual value if it’s totaled or stolen. It helps prevent financial loss in these situations.

What are the legal requirements for car insurance in the United Kingdom?

In the UK, all drivers must have at least third-party liability insurance. This covers damages or injuries you cause to others but not your vehicle.

How does my driving history affect my car insurance coverage?

Your driving history greatly influences your insurance rates. A clean record means lower rates. But, a history of accidents or violations can raise your costs.

What other factors can influence my car insurance coverage?

Other factors include your age, location, vehicle type, and profession. Comparing quotes helps find an affordable plan that fits your needs.

What are the limitations of car insurance coverage?

Insurance coverage has limits like deductibles and policy limits. It also excludes certain damages or incidents. Always review policy details to ensure it meets your needs.