Finding the best insurance providers in the UK can be tough. There are many top insurance companies with lots of affordable options. The right provider is key to getting the coverage you need.

Choosing the best insurance providers means finding what’s right for you. Companies offer health, life, and auto insurance. You can also find affordable options to fit your budget. Knowing what each provider offers helps you make a smart choice.

Key Takeaways

- Research and compare different insurance providers to find the best fit for your needs

- Consider the types of insurance offered by top insurance companies

- Affordable insurance options are available, making it possible to find a policy that fits your budget

- Understand the key factors to consider when choosing the best insurance provider

- Top insurance companies offer a wide range of insurance options, including health, life, and auto insurance

- Choosing the right insurance provider can make a significant difference in ensuring you have the necessary coverage

- Take the time to evaluate and compare different insurance providers to find the best insurance provider for you

Leading Insurance Providers in the UK Market

The UK insurance market is full of choices. To find the right one for you, compare different providers. Look at what reliable insurance providers and leading insurance carriers offer.

There are many types of providers. Traditional companies like Aviva and AXA offer a lot of products. Digital-first providers, such as Direct Line and Admiral, are cheaper but online-only. Specialized carriers, like Hiscox and Markel, focus on specific areas.

When comparing providers, think about these things:

- Coverage options and policy features

- Premium prices and discounts

- Customer service and support

- Claims handling and payout rates

By looking at these points, you can find a reliable insurance provider that fits your needs. Also, check the provider’s reputation and financial health.

Choosing the best insurance provider takes research. Compare what leading insurance carriers offer. This way, you can pick one that gives you the right coverage and support.

How to Compare Best Insurance Providers

When looking for the best insurance, comparing top providers is key. Look at coverage, price, and customer service. This helps you find a policy that fits your needs and budget.

Begin by researching top insurance providers and their policies. Check for health, life, and auto insurance options. Look at coverage, deductibles, and premiums. Also, read reviews and check ratings from independent agencies to see how satisfied customers are.

Here are some key factors to consider when comparing best insurance policies:

- Coverage: What does the policy cover, and what are the limits?

- Price: What is the premium, and are there any discounts available?

- Customer service: What kind of support does the provider offer, and how responsive are they to claims?

By looking at these factors and comparing providers, you can find the best policy for you. Always review the policy terms and conditions before deciding. With the right policy, you can feel secure knowing you’re protected.

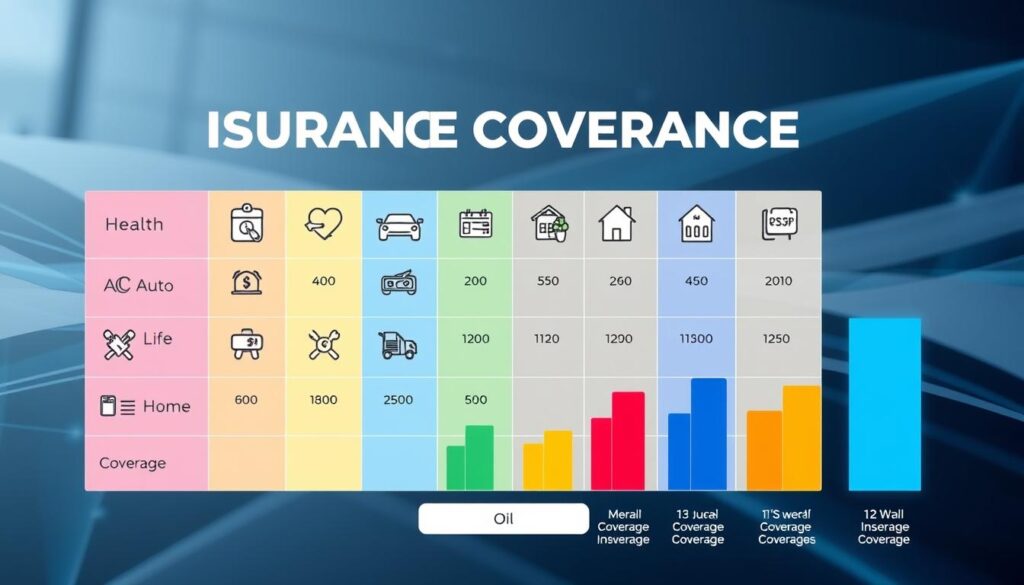

| Insurance Provider | Coverage | Price | Customer Service |

|---|---|---|---|

| Provider A | Comprehensive | Competitive | 24/7 support |

| Provider B | Basic | Affordable | Monday-Friday support |

Conclusion: Making Your Final Insurance Choice

When looking at insurance in the UK, it’s crucial to do your homework. Compare different insurance companies to find the right one for you. Look at what they offer, how much it costs, their customer service, and how financially stable they are.

This way, you can choose wisely and get a policy that really protects you. Whether you prefer a traditional insurer or a new digital company, the main thing is to pick one that meets your needs. This article has given you the tools to make a smart choice and feel secure with your insurance.

FAQ

What are the best insurance providers in the UK?

In the UK, top insurance providers include both old and new companies. AXA, Aviva, Zurich, and Direct Line are leaders. They offer many insurance types, good prices, and great service.

How can I compare insurance coverage and find the most affordable options?

To find the best insurance deals, look at coverage levels, deductibles, and prices. Use online tools and talk to agents for quotes. This way, you can find a policy that’s right for you and your budget.

What are the benefits of choosing a reputable insurance provider?

Going with a trusted insurance company has many perks. You get reliable coverage, good customer service, and financial security. These companies are known for paying claims, offering full policies, and being financially strong.

How can I identify the top-rated insurance providers in the UK?

To find the best insurance companies in the UK, look for high customer satisfaction scores and positive reviews. Check financial ratings from places like A.M. Best. This shows the company is financially stable and can keep its promises.

What types of specialized insurance policies are available in the UK?

The UK offers more than just basic insurance. You can find travel, pet, professional liability, and cyber insurance, among others. Specialized companies often have policies made for specific needs.